Author: R&D Team, CUIGUAI Flavoring

Published by: Guangdong Unique Flavor Co., Ltd.

Last Updated: Feb 02, 2026

Advanced Flavor Formulation Lab

In the hyper-competitive landscape of the 2026 food and beverage (F&B) industry, flavor is the ultimate paradox: it is often the smallest physical component of a formulation, yet it carries the heaviest weight in determining consumer acceptance, brand loyalty, and market longevity. For procurement officers and R&D directors, managing flavor costs is no longer a simple matter of negotiating price-per-kilogram. It has evolved into a multi-dimensional exercise in chemistry, global logistics, regulatory compliance, and sensory science.

As we move through 2026, the global food flavors market has matured into a $16.35 billion powerhouse (The Business Research Company, 2026). However, this growth comes alongside unprecedented volatility in raw material pipelines and shifting “clean label” definitions. If your organization hasn’t benchmarked its flavor spend in the last 18 months, you are likely operating on outdated data.

This comprehensive technical guide explores the current benchmarks for flavor spending, the hidden drivers of cost, and the sophisticated strategies manufacturers are using to optimize their “Cost in Use” (CIU) without compromising the sensory profile of their flagship products.

The primary challenge in benchmarking flavor costs is that there is no “one size fits all” percentage. A high-intensity sweetener and flavor system for a zero-calorie energy drink represents a vastly different cost structure than a savory seasoning for a potato chip. To understand where you stand, we must break down the industry by category and application.

In the beverage industry, flavors must survive high-shear mixing, pasteurization, and long-term storage in varying light and temperature conditions. In 2026, the benchmark for flavor spending in beverages typically ranges from 5% to 12% of total Cost of Goods Sold (COGS).

Bakery and confectionery manufacturers face unique challenges with heat stability. The flavor must be “locked in” to survive oven temperatures exceeding 180°C. Currently, the benchmark for this sector is 2% to 5% of COGS.

The most significant shift in 2026 benchmarking comes from the plant-based meat and dairy sector. Because plant proteins (pea, soy, mycelium) have strong inherent “beany” or “earthy” off-notes, the flavor system does double duty: it must mask the bad while providing the good.

For snacks, flavors are often applied topically. This requires carriers (like maltodextrin or salt) and adhesives (oils).

To benchmark effectively, you must understand what you are paying for. A flavor is not a single ingredient; it is a complex system of aromatic compounds, solvents, and stabilizers.

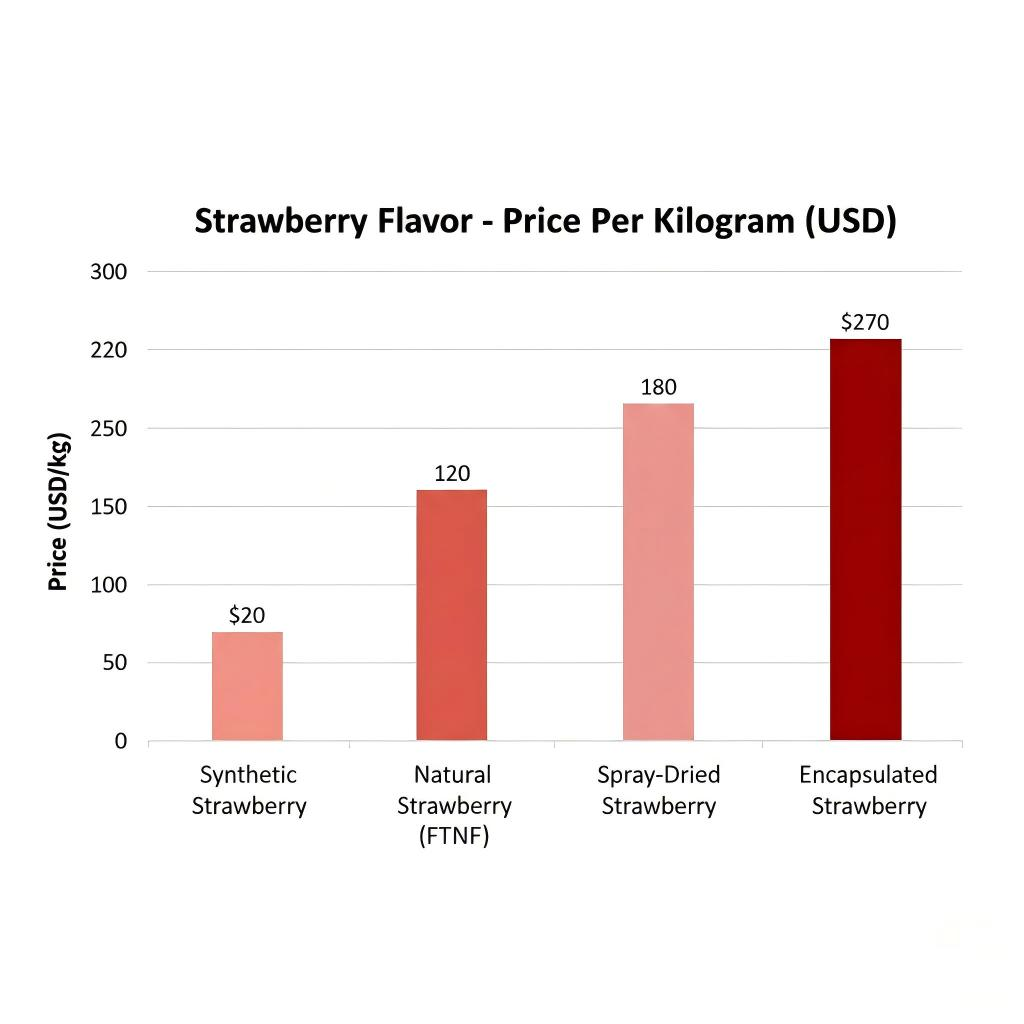

The push for transparency has made “Natural Flavor” the baseline for many brands. However, the technical definition of “natural” varies by region (FDA vs. EFSA), and the cost delta is massive.

The “inactive” part of your flavor also carries a cost.

Strawberry Flavor Cost Comparison

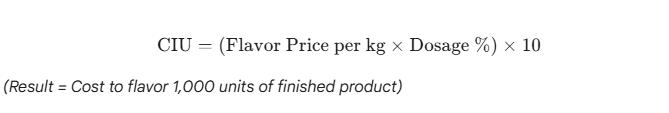

The most common mistake procurement teams make is selecting a flavor based on the price listed on the specification sheet ($/kg). In a professional manufacturing environment, this metric is nearly useless. The only metric that matters is Cost in Use (CIU).

To benchmark your CIU, you must factor in the dosage rate. A flavor that costs $100/kg but is used at 0.01% is significantly cheaper than a flavor that costs $20/kg but requires a 0.5% dosage to achieve the same sensory impact.

Consider two lemon flavors for a 1,000-liter batch of sparkling water:

The Verdict: By choosing the flavor that appeared “3 times more expensive” on the invoice, the manufacturer actually saves 37% on their total production cost. In 2026, market leaders are increasingly moving toward these high-potency concentrates to reduce shipping weights, storage space, and total spend.

The cost of flavor is inextricably linked to global geopolitics and climate reality. In 2026, three major factors are keeping prices elevated across the board.

According to recent industry research, approximately 31% of food flavor exports are currently subject to high-risk volatility due to climate-impacted harvests in tropical regions (Business Research Insights, 2026).

In 2026, regulatory bodies have tightened the definitions of “Natural.” Furthermore, the push for “Sugar Reduction” has led to increased taxes on sweetened beverages in over 50 countries.

Traditional solvent extraction (using hexane or ethyl acetate) is being phased out by premium brands in favor of CO2 Supercritical Extraction.

If your benchmarking shows that you are spending above the 2026 industry average, there are technical levers you can pull to regain control of your margins.

Many large-scale manufacturers suffer from “Flavor Creep.” Over years of R&D, they accumulate 50 different “Vanilla” SKUs from 10 different suppliers.

For products where a “100% Natural” claim isn’t the primary selling point, Hybrid Flavors are the gold standard for cost-efficiency.

In 2026, Gas Chromatography-Mass Spectrometry (GC-MS) technology has become incredibly precise. If you are using an expensive “legacy” flavor, a modern manufacturer can often deconstruct that profile and recreate it using more modern, cost-effective building blocks.

Global Flavor Sourcing Map 2026

As we look toward 2027, the way flavors are priced and developed is being revolutionized by Artificial Intelligence.

Flavor houses are now using AI to predict how flavor molecules will interact with different food matrices. For example, if a manufacturer changes their protein source from whey to soy, AI can instantly suggest the exact masking molecules needed.

In 2026, “Electronic Noses” are being used in manufacturing plants to ensure batch-to-batch consistency. By reducing the number of “rejected batches” due to sensory drift, manufacturers can lower their effective flavor spend by 2–3% annually.

To stay ahead of the benchmark, you must anticipate what is coming. In the next 12 to 24 months, three trends will dominate the cost conversation:

Benchmarking your flavor spend is not a one-time task; it is a continuous process of technical audit and strategic alignment. In 2026, the most successful F&B brands are those that treat their flavor supplier as a technical partner rather than a commodity vendor.

By shifting the focus from Price per Kilo to Cost in Use, consolidating flavor libraries, and embracing new extraction technologies, you can protect your margins while continuing to deliver the “soul” of your product to consumers.

Certified Premium Flavor Product

Are your flavor costs aligned with the 2026 benchmarks? Our technical team specializes in high-efficiency, low-dosage flavor systems designed for the modern F&B landscape.

We invite you to contact us for:

| Contact Channel | Details |

| 🌐 Website: | www.cuiguai.cn |

| 📧 Email: | info@cuiguai.com |

| ☎ Phone: | +86 0769 8838 0789 |

| 📱 WhatsApp: | +86 189 2926 7983 |

| 📍 Factory Address | Room 701, Building 3, No. 16, Binzhong South Road, Daojiao Town, Dongguan City, Guangdong Province, China |

Copyright © 2025 Guangdong Unique Flavor Co., Ltd. All Rights Reserved.